All Categories

Featured

Table of Contents

When life stops, the bereaved have no choice but to keep relocating. Virtually immediately, families must take care of the overwhelming logistics of fatality complying with the loss of an enjoyed one.

In enhancement, a complete death advantage is usually supplied for unintended death. A customized death benefit returns costs typically at 10% rate of interest if death happens in the initial two years and involves the most loosened up underwriting.

To underwrite this company, business depend on individual health meetings or third-party information such as prescription histories, scams checks, or automobile documents. Underwriting tele-interviews and prescription histories can often be made use of to assist the representative complete the application process. Historically companies rely upon telephone meetings to confirm or confirm disclosure, yet extra just recently to enhance customer experience, companies are counting on the third-party data indicated above and giving split second choices at the point of sale without the interview.

Senior Care Final Expenses

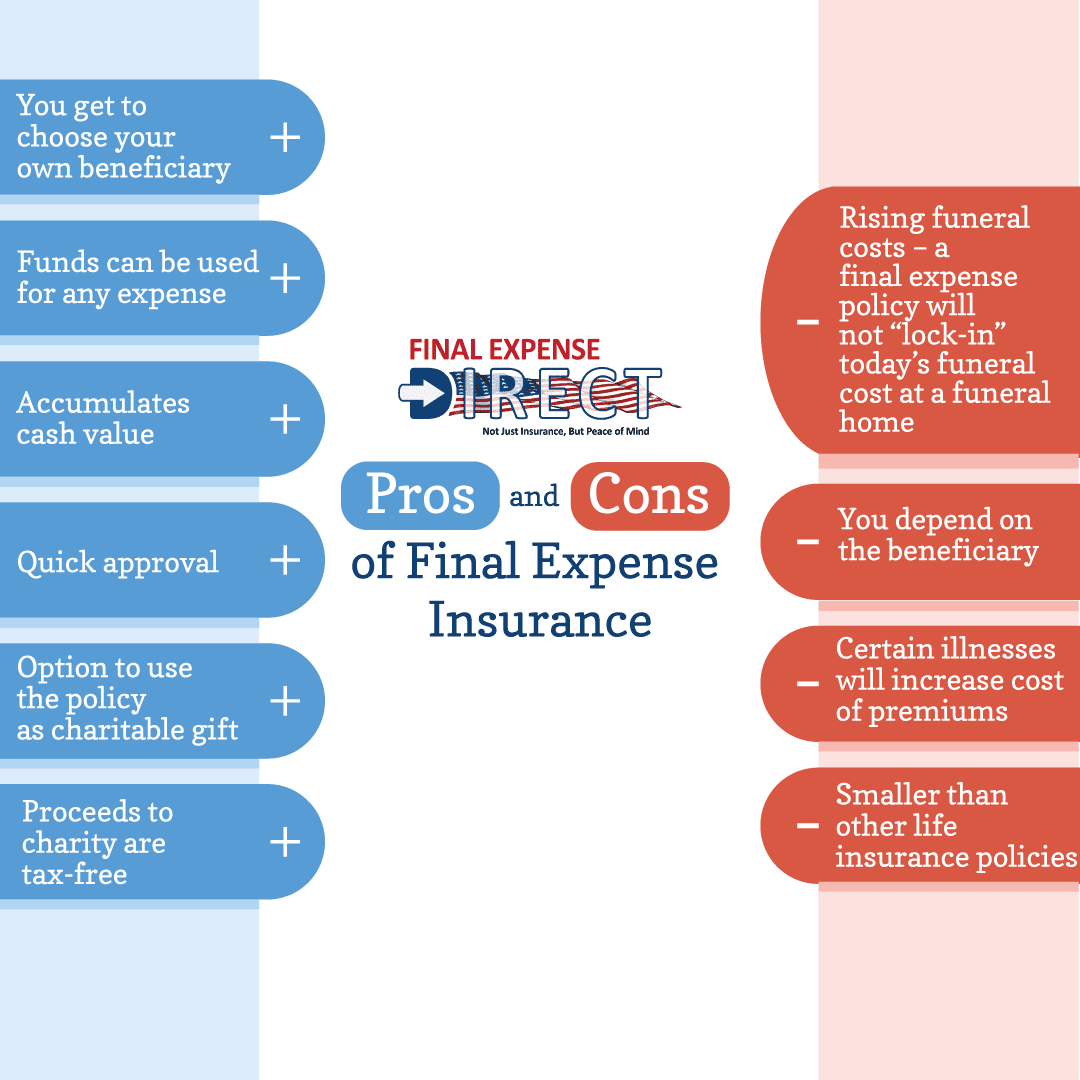

What is last expenditure insurance policy, and is it constantly the ideal course ahead? Below, we take a look at just how final expense insurance policy works and elements to think about prior to you acquire it. Technically, last cost insurance coverage is a whole life insurance policy policy particularly marketed to cover the expenses related to a funeral, funeral, reception, cremation and/or burial.

Yet while it is referred to as a plan to cover last costs, recipients that obtain the fatality benefit are not called for to use it to spend for last expenditures they can utilize it for any kind of objective they such as. That's since last cost insurance coverage truly falls right into the group of customized entire life insurance coverage or streamlined concern life insurance policy, which are generally whole life plans with smaller survivor benefit, commonly in between $2,000 and $20,000.

Our opinions are our own. Interment insurance coverage is a life insurance plan that covers end-of-life costs.

Seniors Funeral Plan

Interment insurance coverage needs no clinical test, making it easily accessible to those with medical conditions. The loss of an enjoyed one is emotional and traumatic. Making funeral prep work and discovering a means to pay for them while grieving includes another layer of anxiety. This is where having funeral insurance coverage, also called last expense insurance coverage, is available in helpful.

Nevertheless, streamlined problem life insurance policy needs a wellness analysis. If your health condition invalidates you from typical life insurance policy, interment insurance policy might be a choice. Along with less wellness examination requirements, burial insurance policy has a quick turnaround time for approvals. You can get protection within days or perhaps the very same day you apply.

Compare affordable life insurance policy choices with Policygenius. Term and irreversible life insurance, interment insurance policy comes in a number of types. Have a look at your coverage options for funeral service expenditures. Guaranteed-issue life insurance has no wellness requirements and offers quick authorization for coverage, which can be useful if you have serious, terminal, or several health conditions.

Paying For Funeral With Life Insurance

Streamlined problem life insurance policy does not need a clinical exam, but it does need a health survey. This policy is best for those with moderate to modest health problems, like high blood pressure, diabetes mellitus, or asthma. If you do not desire a clinical examination however can get approved for a streamlined issue plan, it is generally a better offer than an assured concern plan since you can get even more insurance coverage for a less costly premium.

Pre-need insurance is dangerous due to the fact that the beneficiary is the funeral home and coverage is details to the chosen funeral home. Ought to the funeral home fail or you relocate out of state, you may not have insurance coverage, and that beats the purpose of pre-planning. Additionally, according to the AARP, the Funeral Consumers Partnership (FCA) suggests against buying pre-need.

Those are essentially burial insurance policy policies. For ensured life insurance policy, premium estimations depend upon your age, gender, where you live, and protection amount. Understand that insurance coverage amounts are limited and differ by insurance coverage company. We discovered sample quotes for a 51-year-woman for $25,000 in insurance coverage living in Illinois: You might make a decision to pull out of interment insurance policy if you can or have actually saved up adequate funds to pay off your funeral and any kind of arrearage.

Funeral insurance policy provides a streamlined application for end-of-life coverage. The majority of insurance policy business need you to talk to an insurance policy representative to use for a policy and get a quote.

The objective of living insurance policy is to ease the worry on your liked ones after your loss. If you have a supplementary funeral plan, your enjoyed ones can utilize the funeral policy to take care of final expenses and get an instant dispensation from your life insurance policy to handle the mortgage and education and learning expenses.

People who are middle-aged or older with clinical problems might consider burial insurance policy, as they might not certify for standard policies with more stringent authorization criteria. Furthermore, burial insurance can be valuable to those without comprehensive savings or traditional life insurance policy protection. Interment insurance policy differs from various other kinds of insurance in that it supplies a lower fatality benefit, normally only sufficient to cover expenses for a funeral service and other associated prices.

Burial Insurance For Senior

News & Globe Record. ExperienceAlani has actually evaluated life insurance and pet dog insurance provider and has created many explainers on traveling insurance policy, credit history, financial debt, and home insurance. She is passionate regarding debunking the complexities of insurance coverage and various other personal money subjects to ensure that visitors have the details they need to make the best money decisions.

Final expenditure life insurance coverage has a number of benefits. Last cost insurance coverage is usually suggested for seniors that might not certify for conventional life insurance coverage due to their age.

On top of that, final cost insurance is valuable for people that intend to spend for their own funeral. Burial and cremation solutions can be pricey, so last expense insurance offers assurance knowing that your liked ones will not need to use their cost savings to spend for your end-of-life arrangements. Nonetheless, last expenditure insurance coverage is not the most effective product for every person.

Funeral Cover That Covers Immediately

Getting whole life insurance with Values is fast and very easy. Insurance coverage is offered for elders between the ages of 66-85, and there's no clinical examination required.

Based upon your responses, you'll see your approximated rate and the amount of insurance coverage you receive (in between $1,000-$30,000). You can buy a policy online, and your insurance coverage starts instantly after paying the initial costs. Your price never alters, and you are covered for your entire lifetime, if you proceed making the monthly repayments.

At some point, most of us need to consider just how we'll pay for an enjoyed one's, or perhaps our very own, end-of-life expenses. When you sell last expenditure insurance policy, you can supply your customers with the comfort that includes understanding they and their households are gotten ready for the future. You can additionally get a chance to optimize your book of organization and produce a new earnings stream! Prepared to learn every little thing you need to know to begin selling final expense insurance coverage effectively? No one suches as to assume concerning their own fatality, however the reality of the issue is funerals and funerals aren't low-cost.

On top of that, clients for this kind of plan might have severe lawful or criminal histories. It is essential to note that various service providers use a variety of issue ages on their ensured issue plans as reduced as age 40 or as high as age 80. Some will certainly also provide greater face worths, up to $40,000, and others will permit for far better death advantage conditions by improving the rates of interest with the return of costs or reducing the variety of years until a complete death advantage is offered.

Latest Posts

Does Insurance Cover Funeral Costs

Final Expense Protect Life Insurance

Iselect Funeral Insurance